The acceptance of Bitcoins and other crypto currencies is still manageable if you want to pay with them in a normal supermarket. The Coinbase Card wants to solve this problem and is a VISA debit cardwith which the credit balance in the Coinbase-Wallet can be accessed directly.

Coinbase works with PaySafe together and offers the Coinbase Card in six European countries, including Germany. Interestingly, the map is currently not available in the USA, although Coinbase is based in San Francisco.

After you have downloaded the app, you can use the Issuing fee of € 4,95 order a physical card, which will be delivered after a few days and has a quite "noble" design without a number on the front. Instead, the card number and the CVV number are printed next to each other on the back. After the first payment by PIN, the card can also be used contactless. An important part of the concept is the app, which can be used to select the crypto currency used.

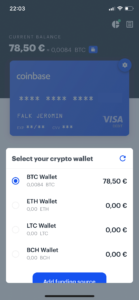

Choice of the cryptocurrency in the Coinbase-Card-App

The app allows you to switch back and forth between different crypto wallets. The prerequisite is, of course, that there is always credit available. The conversion into the respective "FIAT Currency"(in my case first of all only EURO) happens automatically at the time of payment. Basically you can pay with all crypto currencies traded on Coinbase.

Despite the convenience, the "risk" of exchange rate fluctuations remains: an amount of 5 EURO can mean significant differences in the respective currency every minute. Here you should definitely check before each payment how many coins you are currently investing: after all, the exchange rate can rise significantly in a short time, so that you might have preferred to pay for the last beer traditionally with Euros. But the exchange rate risk is no fault of the Coinbase Cardbut will be part of the crypto system as long as the coins are speculated.

Coinbase Card in everyday life

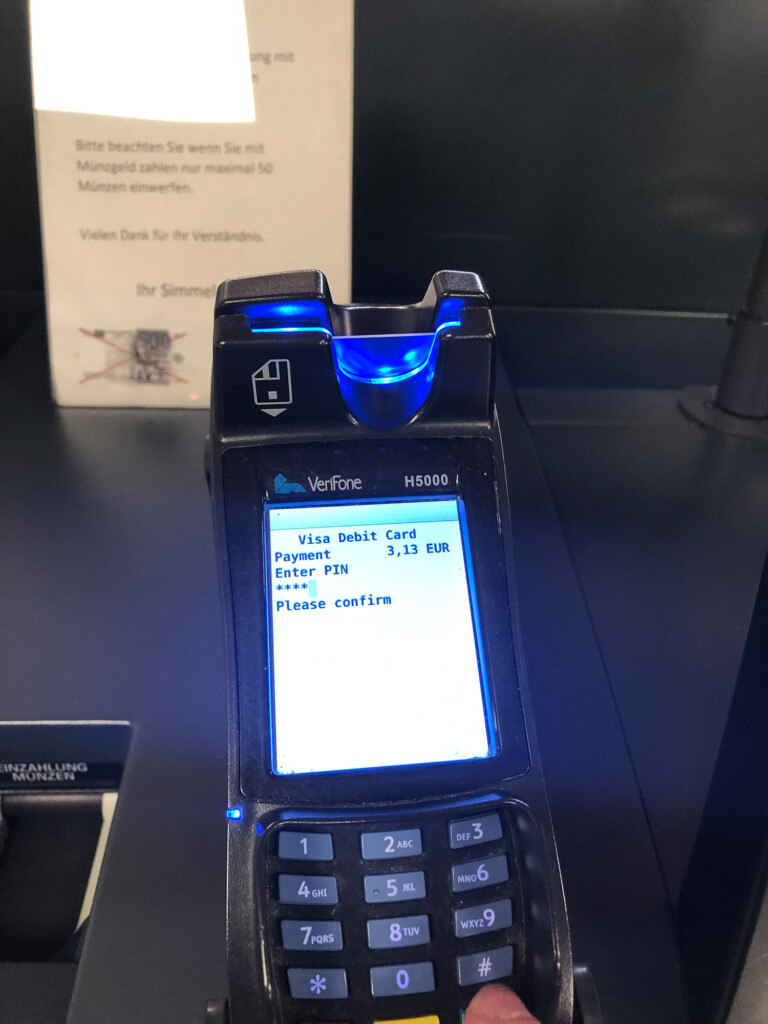

As a test whether the Coinbase Card can really be used like a normal VISA debit card in everyday life, I paid a small amount for breakfast in the nearest EDEKA supermarket at the self-service checkouts. Sales are also displayed directly in the app.

For the first payment the PIN must be entered

The card seems to have an English language setting

Receipt for the amount as with any other VISA card

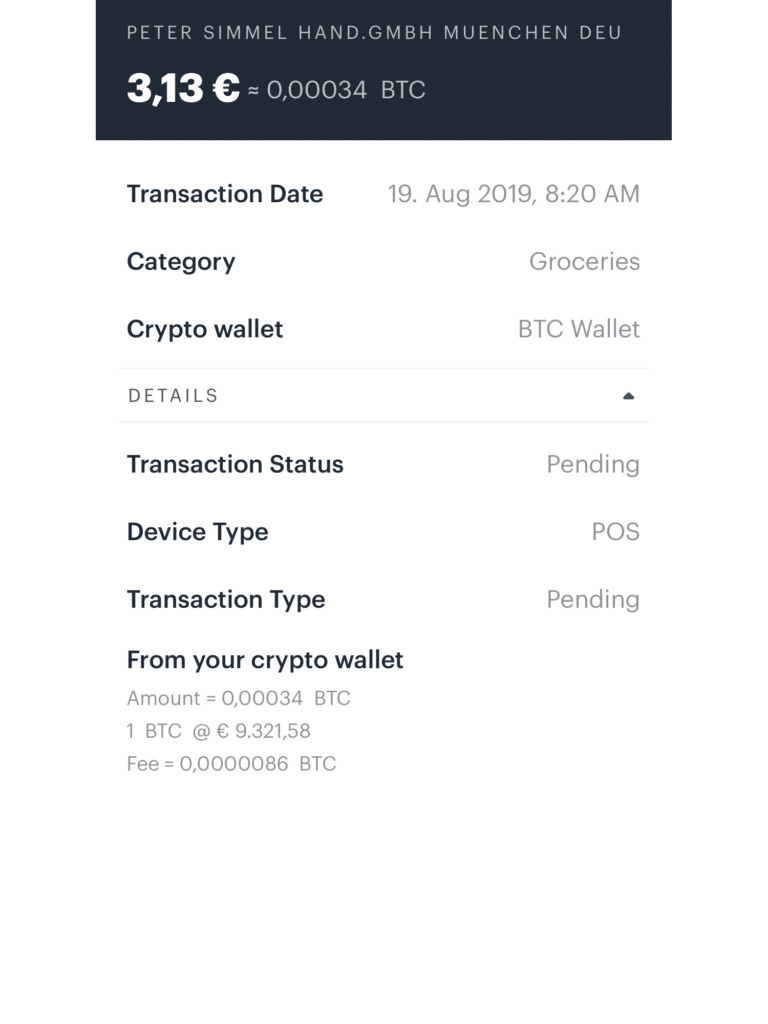

Billing incl. the transaction fee

The payment process is the same as you would expect with any other VISA card. A certain "fee" is charged for the transaction, which in this case is 0.0000086 BTC - for a payment above 0.00034 BTC. At the current exchange rate of 9,643.76 EURO (19.08.2019, 22:26 hrs) this corresponds to 0.083 EURO or 2.65 % of the invoice amount.

The complete price list is available on the Coinbase website for inspection in the Coinbase Card FAQ. Based on the test purchase, it is not yet clear to me at 100% how the actual fees are composed. Maybe there will be some changes, the transaction is still pending. In contrast to paying with a regular credit card, there are additional fees that you should keep in mind when using the card.

Another potentially problematic point is the consideration of payments in the tax return. The exchange of Bitcoin (or other crypto-currencies) into EURO (or any other traditional currency) is quite relevant for the tax office, because either profits are taxable or losses can be taken into account. In any case, you should keep all receipts and discuss it with your tax consultant if necessary.

Preliminary conclusion on the Coinbase Card

With the VISA Debit Card Coinbase provides an easy way to use crypto currencies in everyday life. Once set up, it works like any other debit card. If the question remains as to how payments are to be taken into account in the tax return, in principle Profits from trading with Cryptocurrencies taxed will be.

I probably won't make many payments with the Coinbase Card - nevertheless it is important that new ideas for payments are supported by somebody. Maybe this will also increase the acceptance for cryptocurrencies, which could be interesting as a possible alternative to the current monetary system.